SYCSD & NFLC sponsor a "Give from the Heart" program. NFLC provides $100 funding to each of the 4th grade classes. The students get to choose which charities to give the money to.

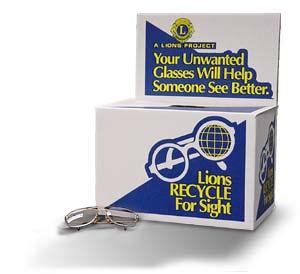

Boxes like this all around the world collect millions of used glasses per year. Lions refurbish them and then donate them to those in need.

In 2012 the New Freedom Lions Club was contacted by Gail Buck as she had a degenerative eye condition and she was going blind.

All smiles as these brothers know they can convert this check to many "Coats of Friendship" for York County Residents.

Please "Read More" for a list of charities that your New Freedom Lions Club contributes to.

100% of all our proceeds go to good work & local charities!

The New Freedom Lions Club runs the carnival every year!

100% of all the proceeds collected goes into the Lions Club Foundation of New Freedom for distribution to our various projects and charities.

Unlike many other charities all the administrative costs for our organization are bourn by our members allowing us to give back as much as we can.

We are part of the largest service club in the world, 1.4 million members strong. “The good we do is the greatest feeling and doing it with the friends we have made makes it all the better.”

Hopefully you have taken a spin around our website to see the many things we do to earn our motto of "We Serve", come join the fun we have while serving.

Please "Read More" about the scientific benefits below.